重要公告

重要公告

查看更多 - 2024/04/23國泰投信系列基金收益分配期前公告(評價日為113.04.30)

- 2024/04/22代ICE Data Indices 轉達關於其旗下基準指數更名公告

- 2024/04/18本公司所經理之國泰美國債券ETF傘型基金之20年期(以上)美國公債指數基金(基金之配息來源可能為收益平準金)申報第十次追加募集,業經財團法人中華民國證券櫃檯買賣中心申報生效並經中央銀行同意,特此公告。

- 2024/04/17國泰美國債券ETF傘型基金之20年期(以上)美國公債指數基金(基金之配息來源可能為收益平準金)第十次追加募集-櫃買中心申報生效公告

- 2024/04/16國泰10年期(以上)BBB美元息收公司債券基金113年第2次收益分配公告

- 2024/04/16國泰15年期以上A等級公用事業產業債券基金113年第2次收益分配公告

| 注意:本公司基金經金管會核准或同意生效,惟不表示基金絕無風險。本公司以往之經理績效不保證基金之最低投資收益;本公司除盡善良管理人之注意義務外,不負責基金之盈虧,亦不保證最低之收益,投資人申購前應詳閱基金公開說明書。投資人可向本公司及基金之銷售機構索取基金公開說明書或簡式公開說明書,或至本公司網站或公開資訊觀測站自行下載。有關基金應負擔之費用已揭露於基金之公開說明書中,投資人可至公開資訊觀測站中查詢。本文提及之經濟走勢預測不必然代表本公司基金之績效,本公司基金投資風險請詳閱各基金公開說明書。 |

| ★ | 基金投資一定有風險,最大可能損失為投資金額之全部,基金所涉匯率風險及其它風險詳參基金公開說明書。 |

| ★ | 投資人應注意債券型基金投資之風險包括利率風險、債券交易市場流動性不足之風險及投資無擔保公司債之風險;該類型基金或有因利率變動、債券交易市場流動性不足及定期存單提前解約而影響基金淨值下跌之風險,同時或有受益人大量贖回時,致延遲給付贖回價款之可能。 |

| ★ | 國泰全球積極組合基金(基金之配息來源可能為本金)及國泰豐益債券組合基金(基金之配息來源可能為本金)得投資於非投資等級債券基金,其投資標的可能包含非投資等級之債券,該等債券之收益雖較高,但仍可能面臨發行公司無法償付本息之信用風險。 |

| ★ | 由於非投資等級債券之信用評等未達投資等級或未經信用評等,且對利率變動的敏感度甚高,故(A)國泰新興非投資等級債券基金(基金之配息來源可能為本金)、(B)國泰全球多重收益平衡基金(本基金有相當比重投資於非投資等級之高風險債券且基金之配息來源可能為本金)、(C)國泰亞太入息平衡基金(本基金有相當比重投資於非投資等級之高風險債券且基金之配息來源可能為本金)、(D)國泰優選1-5年美元非投資等級債券基金、(E)國泰主順位資產抵押非投資等級債券基金(基金之配息來源可能為本金)、(F)國泰六年階梯到期新興市場債券基金(本基金有相當比重投資於非投資等級之高風險債券)、(G)國泰2025到期新興市場債券基金(本基金有相當比重投資於非投資等級之高風險債券)、(H)國泰美國多重收益平衡基金(本基金有相當比重投資於非投資等級之高風險債券且配息來源可能為本金)及(I)國泰亞洲非投資等級債券基金(基金之配息來源可能為本金)可能會因利率上升、市場流動性下降,或債券發行機構違約不支付本金、利息或破產而蒙受虧損。前述基金不適合無法承擔相關風險之投資人。(1)根據前述基金之投資策略與投資特色,前述基金得投資於非投資等級債券,該類債券之風險及波動度較高,適合能承受相關風險之投資人。投資人投資以非投資等級債券為訴求之基金不宜占其投資組合過高之比重。(2)非投資等級債券信用評等投資等級較低,甚至未經信用評等,證券價格亦因發行人實際與預期盈餘、管理階層變動、併購或因政治、經濟不穩定而增加其無法償付本金及利息的信用風險,特別是在於經濟景氣衰退期間,稍有不利消息,此類證券價格的波動可能較為劇烈。(3)除D基金不投資於符合美國Rule 144A規定之債券外,前述其他基金可投資於符合美國Rule144A規定之債券,該類債券屬於私募性質,較可能發生流動性不足,財務訊息揭露不完整或因價格不透明導致波動性較大的風險。 |

| ★ | 由於非投資等級債券之信用評等未達投資等級或未經信用評等,且對利率變動的敏感度甚高,故(A)國泰美國優質債券基金(本基金有一定比重得投資於非投資等級之高風險債券且配息來源可能為本金)、(B)國泰四年到期成熟市場投資等級債券基金(本基金有一定比重得投資於非投資等級之高風險債券且配息來源可能為本金)、(C)國泰三年到期全球投資等級債券基金(本基金有一定比重得投資於非投資等級之高風險債券且配息來源可能為本金)可能會因利率上升、市場流動性下降,或債券發行機構違約不支付本金、利息或破產而蒙受虧損。前述基金不適合無法承擔相關風險之投資人。(1)根據前述基金之投資策略與投資特色,適合追求低風險、低報酬及(A)長期(B)目標期間(四年期)(C)目標期間(三年期)穩健績效之投資人,投資人宜斟酌個人之風險承擔能力及資金之可運用期間長短後辦理投資。投資人投資以非投資等級債券為訴求之基金不宜占其投資組合過高之比重。(2)非投資等級債券信用評等投資等級較低,甚至未經信用評等,證券價格亦因發行人實際與預期盈餘、管理階層變動、併購或因政治、經濟不穩定而增加其無法償付本金及利息的信用風險,特別是在於經濟景氣衰退期間,稍有不利消息,此類證券價格的波動可能較為劇烈。(3)前述基金可投資於符合美國Rule144A規定之債券,該類債券屬於私募性質,較可能發生流動性不足,財務訊息揭露不完整或因價格不透明導致波動性較大的風險。 |

| 國泰7-10年A等級金融產業債券基金、國泰15年期以上A等級科技產業債券基金及國泰15年期以上A等級公用事業產業債券基金為投資於標的指數之成分證券或因應標的指數複製策略所需,得投資非投資等級債券及符合美國Rule 144A規定之債券。非投資等級債券信用評等投資等級較低,甚至未經信用評等,證券價格亦因發行人實際與預期盈餘、管理階層變動、併購或因政治、經濟不穩定而增加其無法償付本金及利息的信用風險,特別是在於經濟景氣衰退期間,稍有不利消息,此類證券價格的波動可能較為劇烈;符合美國Rule144A規定之債券,該類債券屬於私募性質,較可能發生流動性不足,財務訊息揭露不完整或因價格不透明導致波動性較大的風險。 | |

| 國泰15年期以上A等級醫療保健產業債券基金、國泰中國企業7 年期以上美元A 級債券基金及國泰10年以上投資級金融債券ETF基金(基金之配息來源可能為收益平準金)為投資於標的指數之成分證券或因應標的指數複製策略所需,得投資符合美國Rule 144A規定之債券。符合美國Rule144A規定之債券,該類債券屬於私募性質,較可能發生流動性不足,財務訊息揭露不完整或因價格不透明導致波動性較大的風險。 | |

| ★ | 國泰三年到期全球投資等級債券基金(本基金有一定比重得投資於非投資等級之高風險債券且配息來源可能為本金)、國泰四年到期成熟市場投資等級債券基金(本基金有一定比重得投資於非投資等級之高風險債券且配息來源可能為本金)、國泰美國優質債券基金(本基金有一定比重得投資於非投資等級之高風險債券且配息來源可能為本金)、國泰新興非投資等級債券基金(基金之配息來源可能為本金)、國泰全球多重收益平衡基金(本基金有相當比重投資於非投資等級之高風險債券且基金之配息來源可能為本金)、國泰亞太入息平衡基金(本基金有相當比重投資於非投資等級之高風險債券且基金之配息來源可能為本金)、國泰全球積極組合基金(基金之配息來源可能為本金)、國泰主順位資產抵押非投資等級債券基金(基金之配息來源可能為本金)、國泰美國多重收益平衡基金(本基金有相當比重投資於非投資等級之高風險債券且配息來源可能為本金)、國泰亞洲非投資等級債券基金(基金之配息來源可能為本金)及國泰豐益債券組合基金(基金之配息來源可能為本金)配息前未先扣除應負擔之相關費用。基金的配息可能由基金的收益或本金中支付。任何涉及由本金支出的部份,可能導致原始投資金額減損。基金配息率不代表基金報酬率,且過去配息率不代表未來配息率;基金淨值可能因市場因素而上下波動。前述基金配息組成項目相關資料已揭露於國泰投信網站。 |

| ★ | 國泰三年到期全球投資等級債券基金(本基金有一定比重得投資於非投資等級之高風險債券且配息來源可能為本金)、國泰四年到期成熟市場投資等級債券基金(本基金有一定比重得投資於非投資等級之高風險債券且配息來源可能為本金)、國泰美國優質債券基金(本基金有一定比重得投資於非投資等級之高風險債券且配息來源可能為本金)、國泰全球多重收益平衡基金(本基金有相當比重投資於非投資等級之高風險債券且基金之配息來源可能為本金)、國泰亞太入息平衡基金(本基金有相當比重投資於非投資等級之高風險債券且基金之配息來源可能為本金)、國泰美國多重收益平衡基金(本基金有相當比重投資於非投資等級之高風險債券且配息來源可能為本金)、國泰10年期(以上)BBB美元息收公司債券基金(基金之配息來源可能為收益平準金)、國泰10年期以上A等級美元公司債券ETF基金(基金之配息來源可能為收益平準金)、國泰7-10年A等級金融產業債券基金及國泰10年以上投資級金融債券ETF基金(基金之配息來源可能為收益平準金)得投資於由金融機構發行具損失吸收能力之債券,應揭露事項請參閱 https://www.cathaysite.com.tw/uploads/TLAC_COCOBOND.pdf。 |

| ★ | 國泰台灣ESG永續高股息ETF基金(基金之配息來源可能為收益平準金)、國泰全球品牌50 ETF基金(基金之配息來源可能為收益平準金)及國泰台灣領袖50 ETF基金(基金之配息來源可能為收益平準金)、國泰10年以上投資級金融債券ETF基金(基金之配息來源可能為收益平準金)之配息率不代表基金報酬率,且過去配息率不代表未來配息率,基金淨值可能因市場因素而上下波動。基金配息可能由基金的收益平準金中支付。任何涉及由收益平準金支出的部分,可能導致原始投資金額減損。基金配息組成項目相關資料(將)揭露於國泰投信網站。 |

| ★ | 投資地區含新興市場者,因其波動性與風險程度可能較高,且其政經情勢穩定度及匯率走勢亦可能使資產價值受不同程度影響。 |

| ★ | 國泰中港台基金、國泰中國內需增長基金、國泰中國新興戰略基金、國泰富時中國A50基金、國泰富時中國A50單日正向2倍基金、國泰富時中國A50單日反向1倍基金及國泰富時中國5年期以上政策金融債券ETF基金投資地區包含大陸地區者,可能因產業循環或非經濟因素導致價格劇烈波動,另由於大陸地區市場機制不如已開發市場健全且對外匯管制較嚴格,政經情勢或法規變動亦較大,可能對基金報酬產生直接或間接影響。 |

| ★ | 投資人申購前應瞭解國泰泰享退系列基金具有P類型受益權單位及A類型受益權單位。P類型受益權單位具有較低經理費及享有銷售機構之申購手續費優惠,惟須受每月以定期定額方式連續扣款成功達24個月(含)以上之限制,若因投資人申請終止扣款、辦理買回基金(不接受部分買回)或帳戶扣款失敗者,視為扣款不連續,投資人須返還持有期間之P類型受益權單位與A類型受益權單位經理費差額且銷售機構得於P類型受益權單位之申購發生扣款不連續之情形時收取原應收之申購手續費,並將投資人P類型受益權單位轉換為A類型受益權單位;A類型受益權單位,不受每月以定期定額方式連續扣款成功達24個月(含)以上之限制,惟其經理費較P類型受益權單位為高。投資人應依本身投資理財規劃,自行判斷選擇投資P類型受益權單位或A類型受益權單位。國泰泰享退系列基金P類型約定不得互相轉換。 國泰泰享退系列基金P類型受益權單位僅得透過基富通銷售。P類型受益權單位之定期定額申購與勞工退休金條例之勞工每月自願提繳退休金無關,投資人係以自有資金定期定額投資基金,應自負盈虧,且無稅賦優惠。 |

| ★ | 國泰六年階梯到期新興市場債券基金(本基金有相當比重投資於非投資等級之高風險債券)六年期滿即信託契約終止,經理公司將根據屆時淨資產價值進行償付,本基金非為保本型或保證型投資策略或定存之替代品,亦不保證投資收益率與本金之全額返還。投資組合之持債在無信用風險發生的情況下,隨著愈接近到期日,市場價格將愈接近債券面額,惟本基金仍可能存在違約風險與價格損失風險。 本基金屆滿五年後,經理公司得依其專業判斷,於持有之「新興市場債券」到期後,投資短天期債券(含短天期公債),不受信託契約第14條第1項第4款所訂「投資於”新興市場債券”總金額不得低於本基金淨資產價值之60%(含)以上」之限制。所謂「短天期債券」係指剩餘到期年限在3年(含)以內之債券。 投資人應特別留意,經理公司得於本基金募集期間視基金達首次最低淨發行總面額之情形而決定是否再繼續受理投資人申購。本基金成立日之次一營業日起即不再接受受益權單位之申購,除定期買回日與到期買回日外,得於每營業日提出買回申請。惟基金未到期前申請買回,除自本基金成立日之次一營業日起五個營業日(含)期間之買回申請外,將收取提前買回費用2%並歸入基金資產,以維護既有投資人利益。本基金不建議投資人從事短線交易並鼓勵投資人持有至基金到期。 本基金訂有定期買回日,受益人授權經理公司於第2年定期買回日及第3年定期買回日當日,分別將受益人所持有受益權單位總數之5%辦理買回,於第4年定期買回日當日將受益人所持有受益權單位總數之10%辦理買回及於第5年定期買回日當日將受益人所持有受益權單位總數之15%辦理買回。本基金於信託契約存續期間內,自成立日之次一營業日起屆滿第2、3、4、5年當日為該年度之定期買回日;如當日為非營業日,則順延至次一營業日。除於第2、3、4及5年定期買回日外,受益人並得依其需要隨時辦理買回申請,惟定期買回日及到期買回當日,皆不接受受益人提出買回之請求。 另本基金因計價幣別不同,投資人申購之受益權單位數,於本基金成立日前,為該申購幣別金額除以面額計。於召開受益人會議時,各計價幣別受益權單位每受益權單位有一表決權,不因投資人取得各級別每受益權單位之成本不同而異。 |

| ★ | 國泰2025到期新興市場債券基金(本基金有相當比重投資於非投資等級之高風險債券)六年期滿即信託契約終止時,經理公司將根據屆時淨資產價值進行償付,本基金非為保本型或保證型投資策略,本基金非定存之替代品,亦不保證投資收益率與本金之全額返還。投資組合之持債在無信用風險發生的情況下,隨著愈接近到期日,市場價格將愈接近債券面額,惟本基金仍可能存在違約風險與價格損失風險。另,投資人申購之受益權單位數為該申購幣別金額除以面額為計,各類型受益權單位每一受益權單位有同等之權利 本基金屆滿5年後,經理公司得依其專業判斷,於本基金持有之「新興市場債券」到期後,投資短天期債券(含短天期公債),不受信託契約第14條第1項第4款所訂「投資於”新興市場債券”總金額不得低於本基金淨資產價值之60%(含)以上」之限制。所謂「短天期債券」係指剩餘到期年限在3年(含)以內之債券。 投資人應特別留意,經理公司得於本基金募集期間視基金達首次最低淨發行總面額之情形而決定是否再繼續受理投資人申購。本基金成立日當日起即不再接受受益權單位之申購,並得於每營業日提出買回申請,惟基金未到期前申請買回,將收取提前買回費用2%並歸入基金資產,以維護既有投資人利益。本基金不建議投資人從事短線交易並鼓勵投資人持有至基金到期。 |

| ★ | 國泰全球數位支付服務ETF基金以追蹤標的指數「Solactive全球數位支付服務指數」績效表現為目標,係以持有標的指數之成分股為主,並不直接投資比特幣或其他加密貨幣、亦不間接透過衍生性商品或基金投資比特幣或其他加密貨幣。 |

| ★ | 國泰富時中國A50基金、國泰富時中國A50單日正向2倍基金、國泰富時中國A50單日反向1倍基金、國泰日經225基金、國泰臺灣加權指數單日正向2倍基金、國泰臺灣加權指數單日反向1倍基金、國泰道瓊工業平均指數基金、國泰道瓊工業平均指數單日正向2倍基金、國泰道瓊工業平均指數單日反向1倍基金、國泰20年期(以上)美國公債指數基金(基金之配息來源可能為收益平準金)、國泰20年期(以上)美國公債指數單日正向2倍基金、國泰20年期(以上)美國公債指數單日反向1倍基金、國泰臺灣低波動股利精選30基金、國泰美國標普500低波動高股息基金、國泰10年期(以上)BBB美元息收公司債券基金(基金之配息來源可能為收益平準金)、國泰新興市場5年期(以上)美元息收投資等級債券基金(基金之配息來源可能為收益平準金)、國泰優選1-5年美元非投資等級債券基金、國泰納斯達克全球人工智慧及機器人基金、國泰富時新興市場基、國泰臺韓科技基金、國泰富時中國5年期以上政策金融債券ETF基金、國泰10年期以上A等級美元公司債券ETF基金(基金之配息來源可能為收益平準金)、國泰標普北美科技ETF基金、國泰7-10年A等級金融產業債券基金、國泰15年期以上A等級科技產業債券基金、國泰15年期以上A等級公用事業產業債券基金、國泰美國短期公債ETF基金、國泰網路資安ETF基金、國泰台灣ESG永續高股息ETF基金(基金之配息來源可能為收益平準金)、國泰台灣5G+通訊ETF基金、國泰全球智能電動車ETF基金、國泰全球基因免疫與醫療革命ETF基金、國泰全球數位支付服務ETF基金、國泰全球品牌50 ETF證券投資信託基金(基金之配息來源可能為收益平準金)、國泰台灣領袖50 ETF基金(基金之配息來源可能為收益平準金)及國泰10年以上投資級金融債券ETF基金(基金之配息來源可能為收益平準金):基金掛牌日前(不含當日),經理公司不接受本基金受益權單位數之買回。。 |

| ★ | 槓桿型ETF及反向型ETF(國泰富時中國A50單日正向2倍基金、國泰富時中國A50單日反向1倍基金、國泰臺灣加權指數單日正向2倍基金、國泰臺灣加權指數單日反向1倍基金、國泰道瓊工業平均指數單日正向2倍基金、國泰道瓊工業平均指數單日反向1倍基金、國泰20年期(以上)美國公債指數單日正向2倍基金及國泰20年期(以上)美國公債指數單日反向1倍基金)特別注意事項: |

| • | 投資人於基金成立日(不含當日)前參與申購所買入的基金每受益權單位之發行價格,不等同於基金掛牌之價格,參與申購投資人需自行承擔基金成立日起自掛牌日止期間之基金淨資產價格波動所產生折溢價風險。基金受益憑證掛牌後之買賣成交價格應依臺灣證券交易所有關規定辦理。各基金以追蹤標的指數或標的指數的正向2倍或反向1倍之表現為目標,除投資績效將受所追蹤之標的指數走勢牽動外,但投資標的流動性、投資地區政經情勢、匯率及法規變動與證券相關商品與現貨資產之正逆價差等亦可能造成基金淨資產價值之變動或與目標表現偏離之情況○此外,國泰20年期(以上)美國公債指數基金(基金之配息來源可能為收益平準金)、國泰20年期(以上)美國公債指數單日正向2倍基金及國泰20年期(以上)美國公債指數單日反向1倍基金因投資標的包含相關債券,利率變動風險可能影響債券之價格及其流動性。投資人宜特別注意前述各項風險。 | |

| • | 有關基金應負擔之費用,包括每日進行部位調整產生之交易價格差異與交易費用及基金其他必要之費用(如:經理費、保管費等),將影響基金追蹤表現,並已揭露於基金之公開說明書中,投資人可至公開資訊觀測站中查詢。 | |

| • | 除專業機構投資人外,首次買賣槓桿或反向指數股票型基金受益憑證者,應符合臺灣證券交易所股份有限公司規定之投資人適格條件:(1)已開立信用交易帳戶;(2)最近一年內委託買賣認購(售)權證成交達十筆(含)以上;(3)最近一年內委託買賣臺灣期貨交易所上市之期貨交易契約成交達十筆(含)以上;(4)有槓桿、反向指數股票型基金受益憑證,或槓桿、反向指數股票型期貨信託基金受益憑證買進成交紀錄;並簽具風險預告書。 |

| (1) | 策略、特性及追蹤標的指數之方式:國泰富時中國A50單日正向2倍基金、國泰富時中國A50單日反向1倍基金、國泰臺灣加權指數單日正向2倍基金、國泰臺灣加權指數單日反向1倍基金、國泰道瓊工業平均指數單日正向2倍基金、國泰道瓊工業平均指數單日反向1倍基金、國泰20年期(以上)美國公債指數單日正向2倍基金及國泰20年期(以上)美國公債指數單日反向1倍基金係採用指數化策略,自掛牌日起分別以追蹤富時中國A50指數單日正向2倍報酬表現、富時中國A50指數單日反向1倍報酬表現、臺灣證券交易所發行量加權股價日報酬正向兩倍指數績效表現、臺灣證券交易所發行量加權股價日報酬反向一倍指數績效表現、道瓊斯工業平均單日正向2倍指數績效表現、道瓊斯工業平均單日反向指數績效表現、彭博20年期(以上)美國公債單日正向2倍指數績效表現及彭博20年期(以上)美國公債單日反向1倍指數績效表現為目標,將每日調整投資組合,使國泰富時中國A50單日正向2倍基金、國泰臺灣加權指數單日正向2倍基金、國泰道瓊工業平均指數單日正向2倍基金及國泰20年期(以上)美國公債指數單日正向2倍基金整體正向曝險部位貼近基金淨資產價值200%;國泰富時中國A50單日反向1倍基金、國泰臺灣加權指數單日反向1倍基金、國泰道瓊工業平均指數單日反向1倍基金及國泰20年期(以上)美國公債指數單日反向1倍基金整體反向曝險部位貼近基金淨資產價值100%。 |

| (2) | 國泰富時中國A50單日正向2倍基金、國泰富時中國A50單日反向1倍基金、國泰道瓊工業平均指數單日正向2倍基金、國泰道瓊工業平均指數單日反向1倍基金、國泰20年期(以上)美國公債指數單日正向2倍基金及國泰20年期(以上)美國公債指數單日反向1倍基金之正向或反向倍數之報酬率,僅限於單日,但前述基金可能因為每日調整投資組合、持有之證券及證券相關商品價格反應不一致、期貨價差變動、匯率變動、指數除息等因素而影響基金單日報酬偏離標的指數或標的指數之單日正向2倍或反向1倍報酬。國泰臺灣加權指數單日正向2倍基金、國泰臺灣加權指數單日反向1倍基金之正向或反向倍數之報酬率,僅限於單日,但前述基金可能因為每日調整投資組合、持有之證券及證券相關商品價格反應不一致、期貨價差變動、指數除息等因素而影響基金單日報酬偏離標的指數報酬率。 |

| (3) | 國泰富時中國A50單日正向2倍基金、國泰富時中國A50單日反向1倍基金、國泰臺灣加權指數單日正向2倍基金、國泰臺灣加權指數單日反向1倍基金、國泰道瓊工業平均指數單日正向2倍基金、國泰道瓊工業平均指數單日反向1倍基金、國泰20年期(以上)美國公債指數單日正向2倍基金及國泰20年期(以上)美國公債指數單日反向1倍基金為策略交易型產品,不適合長期持有,僅符合適格條件之投資人始得交易。 |

| (4) | 國泰富時中國A50單日正向2倍基金、國泰富時中國A50單日反向1倍基金、國泰臺灣加權指數單日正向2倍基金、國泰臺灣加權指數單日反向1倍基金、國泰道瓊工業平均指數單日正向2倍基金、國泰道瓊工業平均指數單日反向1倍基金、國泰20年期(以上)美國公債指數單日正向2倍基金及國泰20年期(以上)美國公債指數單日反向1倍基金具有槓桿或反向風險,其投資盈虧深受市場波動與複利效果影響,與傳統指數股票型基金不同。前述基金不適合追求長期投資且不熟悉前述基金以追求單日報酬為投資目標之投資人。投資人交易前,應詳閱基金公開說明書並確定已充分瞭解基金之風險及特性。 |

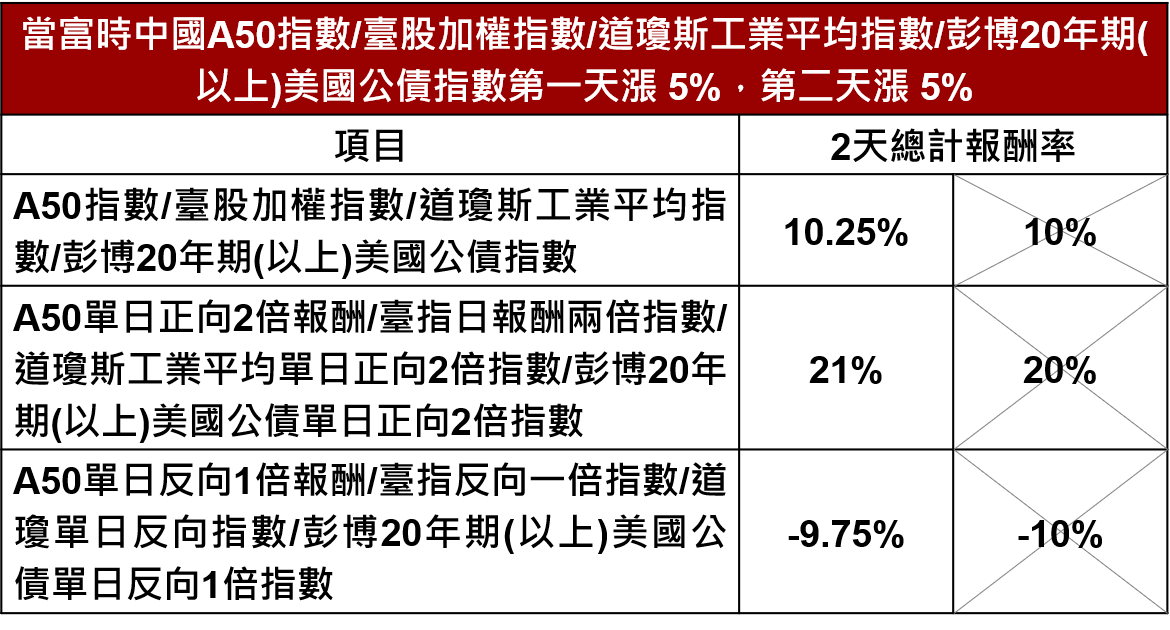

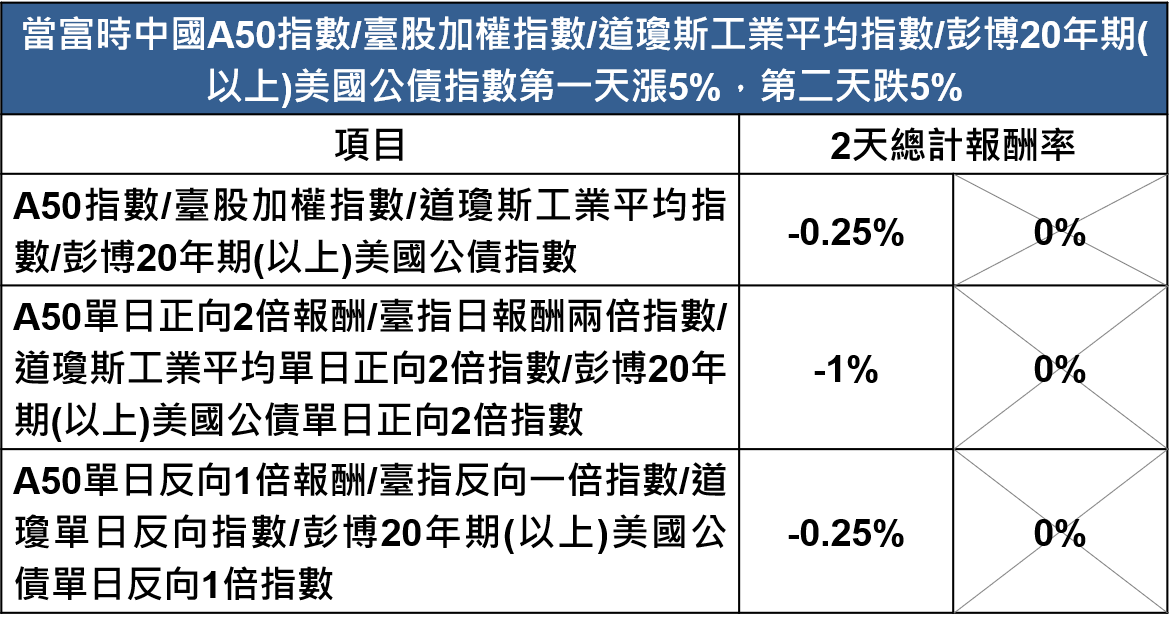

| (5) | 國泰富時中國A50單日正向2倍基金及國泰富時中國A50單日反向1倍基金累積報酬率可能會偏離同期間富時中國A50指數相對應正向倍數或反向倍數之累積報酬。國泰臺灣加權指數單日正向2倍基金及國泰臺灣加權指數單日反向1倍基金累積報酬率可能會偏離同期間標的指數之累積報酬,標的指數累積報酬亦可能會與臺灣證券交易所發行量加權股價指數累積報酬之相對應正向倍數或反向倍數產生偏離。國泰道瓊工業平均指數單日正向2倍基金及國泰道瓊工業平均指數單日反向1倍基金累積報酬率可能會偏離同期間道瓊斯工業平均指數相對應正向倍數或反向倍數之累積報酬。國泰20年期(以上)美國公債指數單日正向2倍基金及國泰20年期(以上)美國公債指數單日反向1倍基金之累積報酬率可能會偏離同期間彭博20年期(以上)美國公債指數相對應正向倍數或反向倍數之累積報酬。關於複利效果釋例說明如下,詳細釋例請見各基金公開說明書。 |

|

|

| 指數授權免責聲明: |

| 「富時中國A50指數」(「指數」) 中之所有權利均歸富時國際有限公司(「富時集團」)所有,指數資料來源為富時國際有限公司(「富時集團」)© FTSE 2015。「FTSE®」為倫敦證券交易所集團公司之商標,由富時集團依據授權使用。富時指數及/或富時評等之所有權利均歸富時集團及/或其授權方所有。富時集團及其授權方拒絕對任何人承擔因富時指數及/或富時評等或其中之資料之錯誤或疏漏所導致之任何責任。未經富時集團之事前書面同意,不得散佈富時資料。 |

| 國泰富時中國A50基金、國泰富時中國A50單日正向2倍基金及國泰富時中國A50單日反向1倍基金(「基金」)由國泰投信獨家開發。該指數由富時集團或其代理機構計算。富時集團及其授權方與「基金」無關,亦不對「基金」進行贊助、提供建議、推薦、認可或推廣,也拒絕對任何人承擔因使用、信賴指數或指數中的任何錯誤,或投資於或經營「基金」所導致的任何責任。富時集團不會對於「基金」所獲得之結果或該指數用於國泰投信所表述之相關目的作出任何聲明、預測、保證或陳述。 |

| 國泰富時新興市場基金(統稱「基金」)全權由經理公司開發。基金與倫敦證券交易所集團公司及其旗下企業(統稱"LSE Group")之間沒有聯繫,也並非受其保證、背書、出售或推廣。 FTSE Russell是LSE Group公司之商號。 |

| 富時新興市場(納入A股)指數(統稱「指數」)的全部權利屬LES Group 旗下持有該指數之公司所有。“FTSE®”、“Russell®”、“FTSE Russell®”均為LSE Group之商標,並由其他LSE Group旗下公司根據授權使用。 |

| 指數由FTSE International Limited、FTSE Fixed Income, LLC或其關係企業、代理人、合作夥伴計算或代其計算。LSE Group概不就(a)使用、依賴指數資料或任何與指數相關之錯誤或(b)本基金之投資或營運對任何人士負法律責任。LSE Group概不就本基金所取得的業績或經理公司提出的指數適合性作出聲明、預測、保證或陳述。 |

| 國泰中國企業7年期以上美元A級債券基金(「基金」)由國泰投信開發。基金與倫敦證券交易所集團公司及其旗下企業(統稱"LSE Group")之間沒有關聯,亦未由其贊助、背書、銷售或推廣。 FTSE Russell是LSE Group公司旗下之企業名稱。 |

| 富時中國美元投資級(A-以上)債券七年期以上精選指數(「指數」)的全部權利皆歸屬於擁有指數之LSE Group旗下公司所有。"FTSE®"、"Russell®"、"FTSE Russell®"、"MTS®"、"FTSE TMX®"、"FTSE4Good®"、"ICB®"、"The Yield Book®"均為相關LSE Group公司之商標,並由其他LSE Group旗下公司根據授權使用。 |

| 指數由FTSE International Limited或其關係企業、代理人、合作夥伴計算或代為之。LSE Group概不就(a)使用、依賴或任何與指數相關之錯誤或(b)基金之投資或營運所致之責任,對任何人負責。LSE Group概不就基金所獲得之結果或國泰投信提出之指數適合性作出聲明、預測、保證或陳述。 |

| 與富時中國政策性銀行債5年期以上指數相關的所有權利皆歸屬於FTSE Fixed Income LLC(下稱「FTSE」)。「FTSE®」係屬London Stock Exchange Group companies所擁有之商標,並經授權由FTSE使用。 |

| 國泰富時中國5年期以上政策金融債券ETF基金(下稱「本基金」)係由國泰投信獨力開發。各該標的指數係由FTSE或其代理人所計算。FTSE及其授權人與本基金無關,FTSE及其授權人未贊助、建議、推薦、認可或推廣本基金,就下列情事所衍生者,FTSE及其授權人對任何人概不負責:(a)使用、信賴本約標的指數,或本約標的指數發生任何錯誤,或(b)投資或運作本基金。國泰投信就基金所得之成果或使用本約標的指數是否合於被授權人之需求,FTSE概不作任何主張、預測、保證或聲明。 |

| 「日經平均股價指數」(以下稱「本指數」)為日商日本經濟新聞社股份有限公司(以下稱「日經公司」)所研發並受著作權保護之商品。本指數包含著作權在內之智慧財產權,均由日經公司所保有。日經公司不負持續發布本指數之義務,且對本指數發布上之錯誤、延遲以及暫停,均不負責。本ETF並未受有日經公司之保薦、推薦或促銷。日經公司對於本ETF之管理與交易,不負任何義務或責任。 |

| 國泰臺灣加權指數單日正向2倍基金及國泰臺灣加權指數單日反向1倍基金並非由臺灣證券交易所股份有限公司(「證交所」)贊助、認可、銷售或推廣;且證交所不就使用「臺灣證券交易所發行量加權股價日報酬正向兩倍指數」和「臺灣證券交易所發行量加權股價日報酬反向一倍指數」及/或該指數於任何特定日期、時間所代表數字之預期結果提供任何明示或默示之擔保或聲明。「臺灣證券交易所發行量加權股價日報酬正向兩倍指數」及「臺灣證券交易所發行量加權股價日報酬反向一倍指數」係由證交所編製及計算;惟證交所不就「臺灣證券交易所發行量加權股價日報酬正向兩倍指數」及「臺灣證券交易所發行量加權股價日報酬反向一倍指數」之錯誤承擔任何過失或其他賠償責任;且證交所無義務將指數中之任何錯誤告知任何人。國泰證券投資信託股份有限公司業已自臺灣證券交易所股份有限公司取得使用臺灣證券交易所發行量加權股價日報酬正向兩倍指數或其簡稱臺指日報酬兩倍指數及臺灣證券交易所發行量加權股價日報酬反向一倍指數或其簡稱臺指反向一倍指數之授權。 |

| 「國泰臺灣低波動股利精選30基金」並非由臺灣指數股份有限公司贊助、認可、銷售或推廣;且臺灣指數股份有限公司不就使用「臺灣指數公司低波動股利精選30指數」或該等指數於任何特定日期、時間所代表數字之預期結果提供任何明示或默示之擔保或聲明。「臺灣指數公司低波動股利精選30指數」係由臺灣指數股份有限公司編製及計算;惟臺灣指數股份有限公司不就「臺灣指數公司低波動股利精選30指數」之錯誤承擔任何過失或其他賠償責任;且臺灣指數股份有限公司無義務將該指數中之任何錯誤告知任何人。 |

| 「國泰臺韓科技基金」並非由臺灣指數股份有限公司或韓國交易所贊助、認可、銷售或推廣,且臺灣指數股份有限公司及韓國交易所不就使用「臺韓資訊科技指數」或該等指數於任何特定日期、時間所代表數字之預期結果提供任何明示或默示之擔保或聲明。「臺韓資訊科技指數」係由臺灣指數股份有限公司及韓國交易所共同編製及計算;惟臺灣指數股份有限公司及韓國交易所不就「臺灣指數公司臺韓資訊科技指數」之錯誤承擔任何過失或其他賠償責任;且臺灣指數股份有限公司及韓國交易所無義務將指數中之任何錯誤告知任何人。 |

| 「臺灣指數公司特選臺灣上市上櫃FactSet 5G+通訊指數」由臺灣指數股份有限公司負責計算及授權國泰證券投資信託股份有限公司於本商品中使用該指數名稱;惟臺灣指數股份有限公司並未贊助、認可或推廣本商品。與指數值及其成分股清單有關之一切著作權均歸臺灣指數股份有限公司所有。國泰證券投資信託股份有限公司業已就使用該著作權發行國泰台灣5G PLUS ETF證券投資信託基金之行為,自臺灣指數股份有限公司取得完整之使用授權。 |

| 道瓊斯工業平均指數(Dow Jones Industrial Average Index)/道瓊斯工業平均指數單日反向指數(Dow Jones Industrial Average PR Inverse Carry-Free Daily Index)/道瓊斯工業平均單日正向2倍指數(Dow Jones Industrial Average PR 2X Leverage Carry-Free Daily Index)(以下統稱「指數」)是S&P Dow Jones Indices LLC或其關係人("SPDJI標普道瓊斯指數")的產品,且已授權予國泰投信使用。Standard & Poor’s®及S&P®為Standard & Poor’s Financial Services LLC("S&P標普")之註冊商標;Dow Jones®為Dow Jones Trademark Holdings LLC("Dow Jones道瓊斯")之註冊商標;這些商標已授權予SPDJI標普道瓊斯指數使用,並已再授權予國泰投信使用於特定用途。SPDJI標普道瓊斯指數、Dow Jones道瓊斯、S&P標普及其各自之關係人均不贊助、擔保、銷售或宣傳國泰美國ETF傘型基金之道瓊工業平均指數證券投資信託基金/國泰美國ETF傘型基金之道瓊工業平均指數單日反向1倍證券投資信託基金/國泰道瓊工業平均指數單日正向2倍基金,且任一方皆不就該產品之可投資性作出任何聲明,對於指數之錯誤、遺漏或中斷亦不負任何責任。更多S&P Dow Jones Indices LLC之指數資料請造訪www.spdji.com。 |

| "標普500低波動高股息指數(S&P 500 Low Volatility High Dividend Index)"與"標普北美科技行業指數(S&P North American Technology Sector Index)"是S&P Global旗下公司S&P Dow Jones Indices LLC或其關係人("SPDJI")的產品,且已授權予國泰投信使用。Standard & Poor’s®與S&P®均為S&P Global旗下公司Standard & Poor’s Financial Services LLC("S&P")的註冊商標;Dow Jones®是Dow Jones Trademark Holdings LLC("Dow Jones")的註冊商標;這些商標已授權予SPDJI使用,並已再授權予國泰投信用於特定用途。SPDJI、Dow Jones、S&P及其各自的關係人均不贊助、擔保、銷售或推廣國泰美國標普500低波動高股息基金與國泰標普北美科技ETF基金,而且他們中的任何一方既不對投資有關產品的合理性做出任何聲明,也不就標普500低波動高股息指數與標普北美科技行業指數的任何錯誤、遺漏或中斷承擔任何法律責任。更多S&P Dow Jones Indices LLC之指數資料請造訪www.spdji.com。 |

| 「彭博®」、彭博20年期(以上)美國公債指數、彭博20年期(以上)美國公債單日正向2倍指數、彭博20年期(以上)美國公債單日反向1倍指數、彭博10年期以上BBB美元息收公司債(中國除外)指數、彭博新興市場5年期以上美元息收投資等級債(中國除外)指數、彭博優選短期美元非投等債(中國除外)指數、彭博10年期以上高評等流動性美元公司債指數、彭博7-10年美元金融債精選指數、彭博15年期以上科技業美元公司債精選指數、彭博15年期以上公用事業美元公司債精選指數、彭博15年期以上醫療保健業美元公司債精選指數、彭博美國短期公債收益指數及彭博10 年以上美元金融債券指數為Bloomberg Finance L.P.及其關係企業(包括指數管理公司—彭博指數服務有限公司(「BISL」))(統稱「彭博」)的服務商標,且已授權由國泰投信用於若干用途。彭博與國泰投信並無關聯,且彭博並不會審批、認證、審查或推薦國泰20年期(以上)美國公債指數基金(基金之配息來源可能為收益平準金)、國泰20年期(以上)美國公債指數單日正向2倍基金、國泰20年期(以上)美國公債指數單日反向1倍基金、國泰10年期(以上)BBB美元息收公司債券基金(基金之配息來源可能為收益平準金)、國泰新興市場5年期(以上)美元息收投資等級債券基金(基金之配息來源可能為收益平準金)、國泰優選1-5年美元非投資等級債券基金、國泰10年期以上A等級美元公司債券ETF基金(基金之配息來源可能為收益平準金)、國泰7-10年A等級金融產業債券基金、國泰15年期以上A等級科技產業債券基金、國泰15年期以上A等級公用事業產業債券基金、國泰15年期以上A等級醫療保健產業債券基金、國泰美國短期公債ETF基金及國泰10年以上投資級金融債券ETF基金(基金之配息來源可能為收益平準金)(以下統稱「基金」)。彭博不就基金任何相關資料或資訊之即時性、準確性或完整性作出任何保證。 |

| Nasdaq®、NASDAQ®、Nasdaq CTA Artificial Intelligence and Robotics IndexSM、納斯達克CTA全球人工智慧及機器人指數、納斯達克全球人工智慧及機器人指數、美國費城半導體指數及納斯達克ISE全球網路資安指數係屬Nasdaq, Inc.(連同其關係企業,下稱「本公司」)所擁有之註冊商標,並被授權允許經理公司使用。關於各該商品的合法性或適合性並未經本公司批准。各該商品亦非由本公司所發行、認可、出售或推廣。就各該商品,公司概不作任何保證亦不負擔任何責任。 |

| 本文中所稱的基金或證券並非由MSCI贊助、背書或推廣,且MSCI就任何該等基金或證券或該等基金或證券所基於的任何指數不承擔任何責任。國泰台灣ESG永續高股息ETF基金(基金之配息來源可能為收益平準金)及國泰台灣領袖50 ETF基金(基金之配息來源可能為收益平準金)公開說明書中載有對MSCI與國泰投信之間有限的關係以及任何相關基金更詳細的描述。 |

| 國泰全球智能電動車ETF基金及國泰全球品牌50 ETF基金(基金之配息來源可能為收益平準金) (以下統稱「基金」)為ICE Data指數有限公司或其關係人之服務商標,業經授權予國泰投信就基金與ICE FactSet 全球智能電動車指數(ICE FactSet Global Autonomous & Electric Vehicles Index)及ICE FactSet 全球品牌50指數(ICE FactSet Global Top 50 Brands Index)(以下統稱「標的指數」)一併使用。國泰投信或產品皆未經ICE Data指數有限公司、其關係人或其第三方供應商(以下稱ICE Data及其供應商)之贊助、背書或由其銷售或促銷。ICE Data及其供應商對於一般投資於有價證券之建議未作出聲明或保證,尤其是商品、信託或指數追蹤一般市場績效的能力。指數之過往績效不代表或保證未來之表現。 |

| ICE DATA及其供應商對於指數、指數數據或其包含之資訊、與之相關或其衍生之資訊(以下稱「指數數據」)之商品適銷性、適合性或作為特定用途之保證,無論明示或默示,茲聲明免責。ICE DATA及其供應商針對指數、指數數據係以「現狀」提供,故不應就其精確性、正確性、及時性或完整性之損害或責任負責。使用者應自行承擔風險。 |

| 國泰全球基因免疫與醫療革命ETF基金及國泰全球數位支付服務ETF基金(以下統稱「基金」)未受Solactive AG以任何形式贊助、宣傳、銷售或支持,Solactive AG亦不就在任何時點或任何方式使用指數及/或指數商標或指數價格之結果提供任何明示或默示保證或確認。無論在任何時點或任何方式使用指數之結果及/或指數商標或指數價格,亦同。完整版聲明請參閱本基金公開說明書。 |